Not all information is official yet but, like last year, it appears that shortfalls exist in the 2025 ad valorem tax collections for all but two of the Disney Vacation Club resorts located at Walt Disney World.

In anticipation of property tax bills being released by November 1, the Orange County Property Assessor has finalized the appraisal values that it will use for the 2025 tax year. Taxing authorities have proposed tax rates for 2025, which should be finalized in short order.

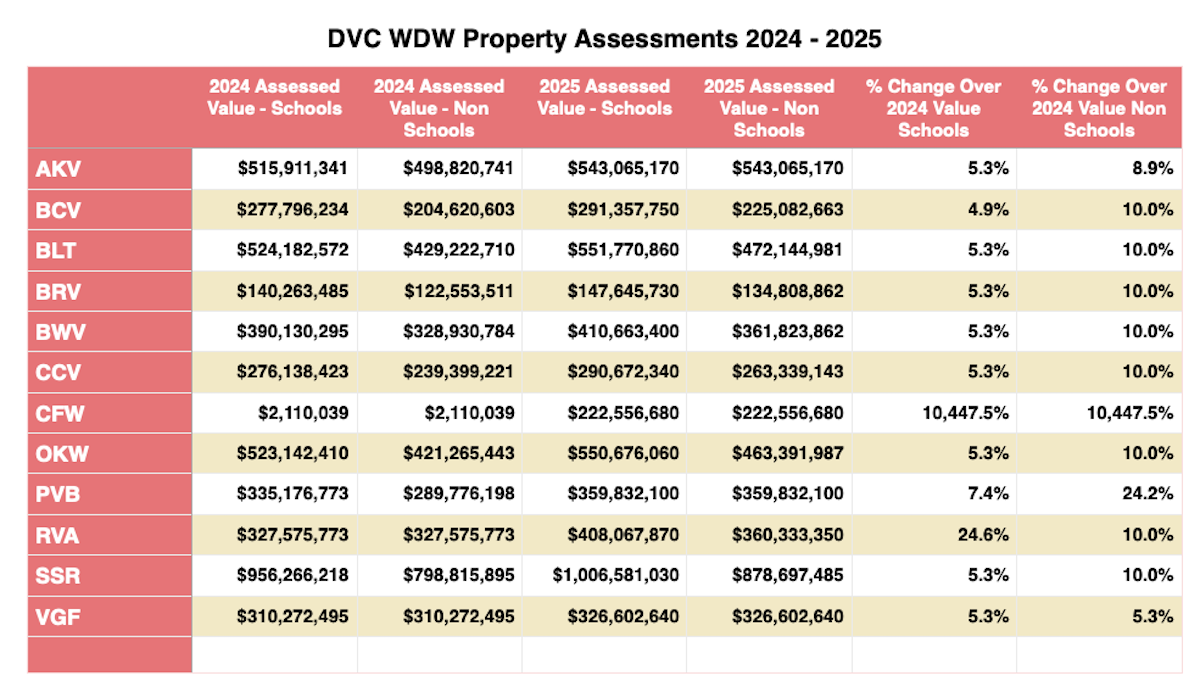

Property Assessments

In 2025, property appraisal values have increased for all twelve Disney Vacation Club resorts. For the first time, one DVC resort is now valued at over $1 billion.

Florida uses a two-tiered method in determining the taxable value of a non-homestead property, such as a timeshare. School related taxing authorities at the local and state levels assess property at market value and are not subject to a cap in the amount the assessment can increase from year to year. DVC resorts are subject to two school related authorities, one at the State level and another at the Local Orange County level.

Non-school taxing authorities also base their assessments on market value but yearly increases cannot exceed 10% over the assessment used by those authorities in the previous year. DVC resorts are subject to the following non-school taxing authorities: Orange County taxes, city taxes (either City of Bay Lake or City of Lake Buena Vista), Library taxes, South Florida Water Management District taxes, and Central Florida Tourist Oversight District taxes, the successor to the Reedy Creek Improvement District.

The chart below shows each resort’s appraisal values for 2024 and 2025.

For example, Disney’s Saratoga Springs Resort & Spa has a 2025 assessed value of $1,006,581,030, the first Walt Disney World DVC resort to exceed $1 billion in valuation. The 2025 market assessment is 5.3% greater than its 2024 value. This is the assessment that is used to compute the school related taxes. The five non-school taxing authorities that have Saratoga Springs in their jurisdictions will use an assessed value of $878,697,485. This is because the value used in 2025 cannot increase more than 10% over the 2024 value used by those authorities, which was $798,815,895.

Both Disney’s Animal Kingdom Villas and The Villas at Disney’s Grand Floridian Resort had less than 10% increases in their non-school assessment values because those assessments match their full market value.

The Cabins at Disney’s Fort Wilderness Resort and Disney’s Polynesian Villas & Bungalows are not yet fully declared and had more inventory added since the 2024 appraisal was made. Thus, their assessment values are not limited to a 10% cap as other fully declared resorts. Disney’s Riviera Resort is also not yet fully declared but the Orange County Property Appraiser still capped its non-school assessment value at 10%.

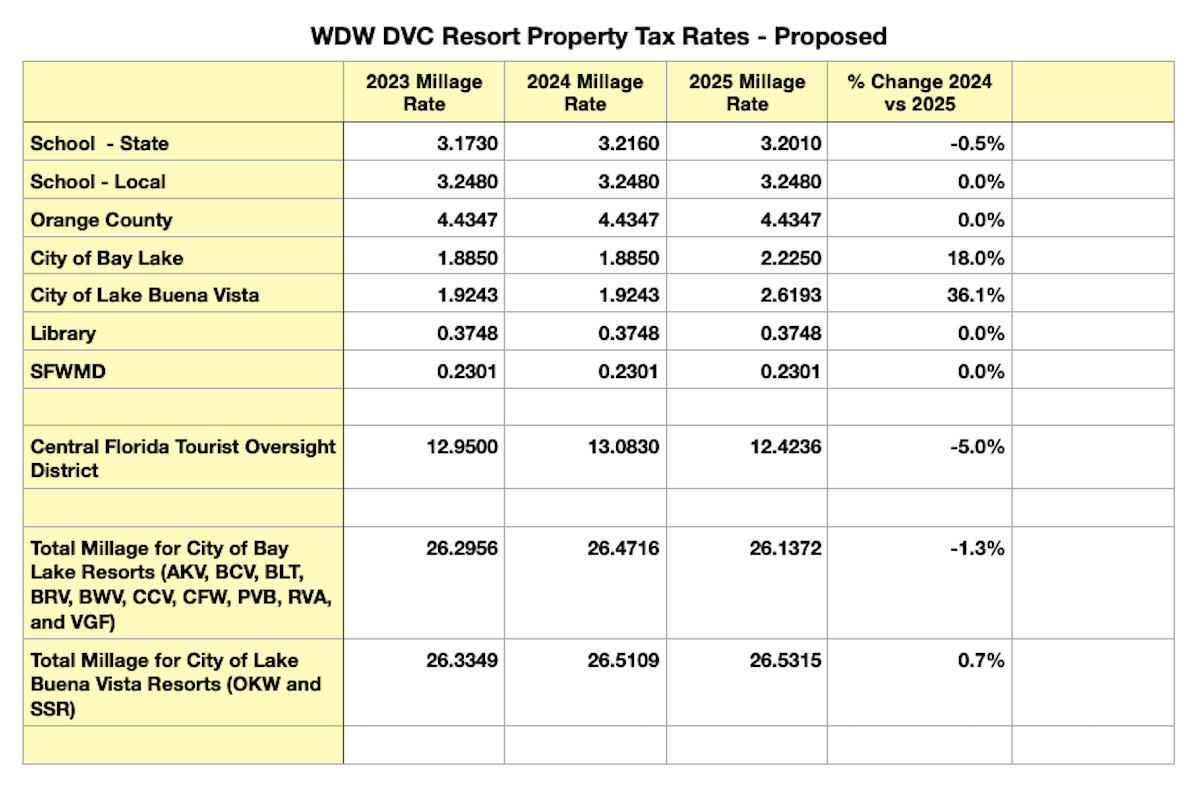

Tax Rates

In addition to its property appraisal value, a resort’s tax bill is dependent on the millage rates set by the taxing authorities. Each DVC resort is subject to taxes levied by seven taxing authorities, including a city property tax. Disney’s Old Key West Resort and Saratoga Springs are taxed by the City of Lake Buena Vista, while the other 10 resorts are subject to taxation by the City of Bay Lake.

The tax rates presented here have not yet been declared official by the Orange County authorities. Instead, they are the tax rates for the budgets actually proposed by each local taxing authority, which may be amended after public hearings that were held in September. Past history has shown that these proposed tax rates are seldom changed. Florida law requires that property tax bills be released prior to November 1, at which time we will know the actual tax rates.

In 2025, four of the seven taxing authorities for each DVC resort — School-Local level, Orange County, Library, and South Florida Water Management District — are keeping their millage rates at the same level as in 2024. Two other authorities — School State and Central Florida Tourist Oversight District — are reducing their rates.

Both the City of Bay Lake and City of Lake Buena Vista are increasing their millage rate by significant amounts: 18.0% and 36.1%, respectively.

Because of these changes, the DVC resorts located in the City of Lake Buena Vista (Old Key West and Saratoga Springs) will have a 0.7% increase in their overall millage rate in 2025. The resorts located in the City of Bay Lake (Animal Kingdom, Beach Club, Bay Lake Tower, Boulder Ridge, Boardwalk, Copper Creek, Cabins at Fort Wilderness, Polynesian, Riviera, and Grand Floridian) will have a decrease in their millage rate of 1.3%

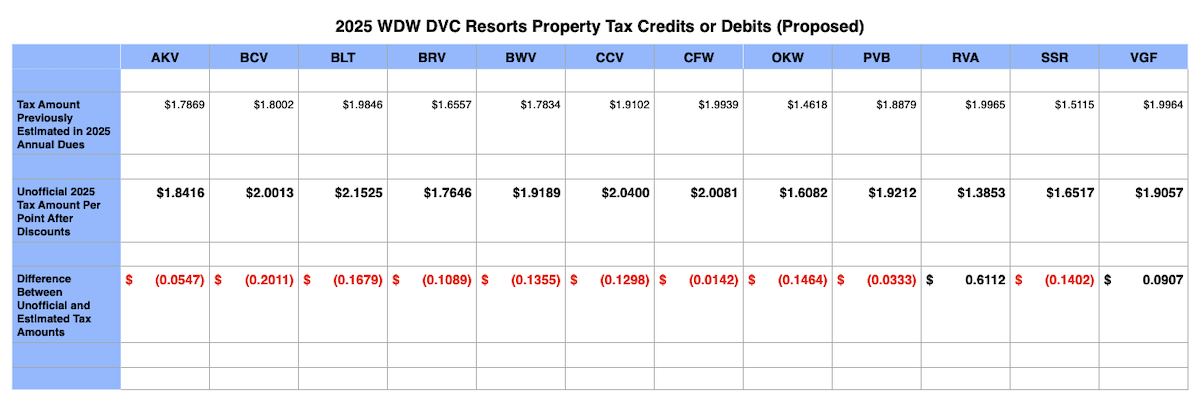

Property Tax Credits and Shortfalls By Resort

In December of each year the DVC Board of Directors approves the annual budgets for the DVC resorts. When the budgets are approved, the Board can only estimate what the property taxes may be for the upcoming year. This is because the actual tax amount charged against a resort in Florida is not finalized until October of the following year.

In some years, the estimated taxes are higher than the actual tax amount. When that happens a credit is applied to the maintenance fees that will be billed in the following year. If the actual tax amount is higher than the estimated amount, then an additional debit is assessed and added to the Annual Dues billed in the following year to recover the shortfall.

In December 2024, the Board estimated the 2025 property taxes for Disney’s Saratoga Springs Resort would be $1.5115 a point. This amount was included in the 2025 Annual Dues for Saratoga Springs resort owners.

If the final 2025 tax bills released by the Orange County Tax Collector use the proposed millage rates shown above, then Saratoga Springs will be charged $22,586,101.01 in property taxes, which equates to about $1.6517 per point. This amount reflects a 4% discount offered by the State of Florida on the tax bill if paid before December 1. Since Saratoga Springs’ actual tax amount is more than the estimated amount, owners of that resort should see a shortfall of roughly $0.1402 per point. If a DVC member owns 100 SSR points, they should expect an additional debit of about $14.02 on their 2026 Annual Dues statement.

Most Walt Disney World DVC resorts appear to have had their property taxes underestimated and will have the shortfall added to their 2026 Annual Dues statements. Two resorts —Riviera and Grand Floridian — appear to have their taxes overestimated and will receive a credit for the overage on their 2026 Annual Dues statements.

The chart below shows the amount of shortfall and credit that the DVC resorts at Walt Disney World should receive due to under- or overpayment of 2025 property taxes.

These credits and debits will be assessed to the DVC member who owns the deed when the Annual Dues are billed in December 2025. The 2026 Annual Dues statements should be available on the DVC member website about a week or two after the 2025 Condominium Association Meetings in early December.

Please note that these estimates of tax credits and debits are based on publicly available information on property appraisals and tax rates. DVC members should rely on official information released by Disney to determine what, if any, credits or debits apply to their account.

Wil Lovato is a contributor to DVCNews.com and has been a Disney Vacation Club owner since 2009. His DVC Home Resorts include Copper Creek Villas, Bay Lake Tower, Animal Kingdom Villas, and Aulani. He can be found posting on many Disney discussion forums under the username of “wdrl.”